Breaking Industry News

Breaking Industry News

Breaking News articles for May 2024

Quick takes: Things that caught our eye this week

Friday, May 31, 2024

Nacha's Payments Innovation Alliance, through its Cybersecurity & Payments AI Project Team, debuted a new resource with the release of the Security Incident Response Procedure Guide for Companies. This free guide outlines essential procedures and actions for companies to follow upon suspecting a security incident or breach involving sensitive data.

J.D. Power: Digital banking, credit tools promising but lack personalization

Thursday, May 30, 2024

While U.S. banks and credit card providers have excelled in creating efficient digital platforms, they struggle to build distinctive, personalized customer relationships in an increasingly homogenous market, according to recent J.D. Power studies.

Extended deadline offers merchants reprieve in $5.5B settlement

Tuesday, May 28, 2024

The United States District Court, Eastern District of New York extended the deadlines for claims in the In re Payment Card Interchange Fee and Merchant Discount Antitrust Litigation settlement to Aug. 30, 2024. This extension gives businesses an additional 90 days to take part in what has become the nation's largest antitrust class-action settlement, totaling $5.5 billion.

Things that caught our eye this week

Friday, May 24, 2024

The Consumer Financial Protection Bureau (CFPB) filed a lawsuit against the online lending platform SoLo Funds, accusing the company of deceptive practices by misleading borrowers about the total costs of their loans.

BNPL lenders under same rules as credit card providers, CFPB finds

Wednesday, May 22, 2024

In a landmark move, the Consumer Financial Protection Bureau issued an interpretive rule confirming that buy now, pay later (BNPL) lenders fall under the same regulatory framework as credit card providers.

Banks, merchants blast Fed over debit pricing plan

Wednesday, May 22, 2024

The Federal Reserve is getting significant blowback on its plan to lower the ceiling on permissible debit card interchange. The Fed said it has received over 2,500 comment letters, many representing the opinions of multiple organizations. But a large number were identical form letters, which the Fed declined to post for review.

Weavr studies embedded finance in B2B SaaS sector

Tuesday, May 21, 2024

In a new report, embedded finance expert Weavr, revealed that the majority of business-to-business (B2B), software-as-a-service (SaaS) product managers are gearing up to integrate embedded finance into their strategic plans.

Green Sheet interviews LexisNexis Risk Solutions' Kimberly Sutherland

Monday, May 20, 2024

Recently Kimberly Sutherland, vice president, fraud and identity at LexisNexis Risk Solutions provided commentary to The Green Sheet on the hot topic of AI's role in fraud prevention and detection in the following Q&A:

Visa thinks one card should be all you need

Friday, May 17, 2024

Visa wants to reinvent the way consumers pay with credit and debit cards. A litany of new features and functionality, revealed by the card company this week, aim to change the way consumers use payment cards and how Visa and financial institutions address card fraud.

Items of interest we came across this week

Friday, May 17, 2024

The Supreme Court ruled on Thurs. May 16, 2024, that the Consumer Financial Protection Bureau's funding mechanism, which bypasses the congressional appropriations process, is constitutional. The 7-2 decision preserves the agency’s independent funding model and affirms its legitimacy.

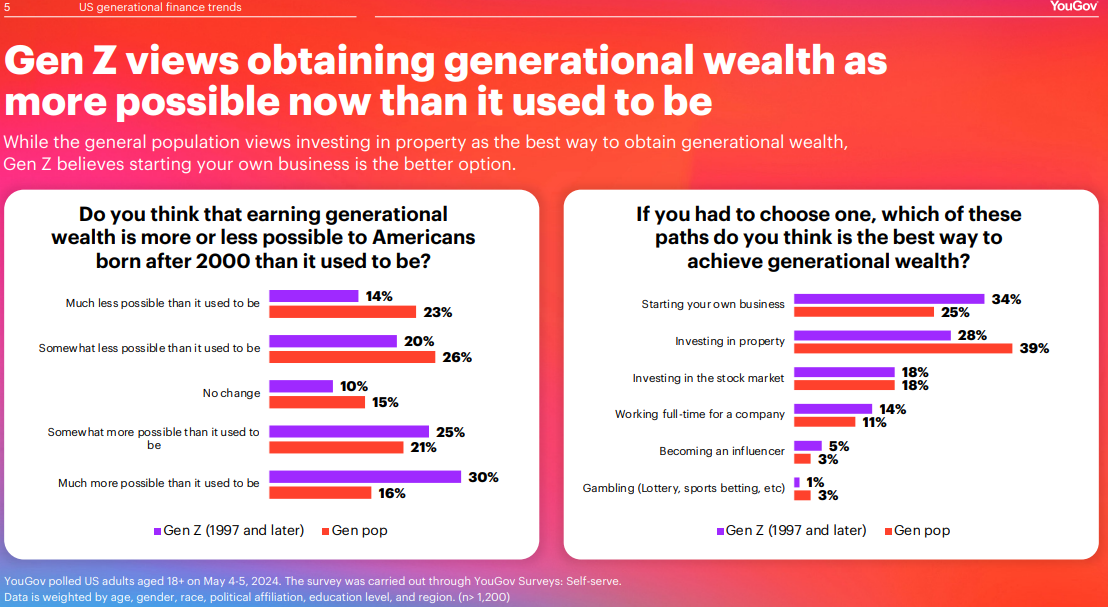

New report explores differing financial attitudes per generation

Thursday, May 16, 2024

For retailers, ISOs, merchant level salespeople and other merchant services providers seeking to tailor their offerings to the distinct needs of today's generations, a new report from YouGov might provide useful insights.

For retailers, ISOs, merchant level salespeople and other merchant services providers seeking to tailor their offerings to the distinct needs of today's generations, a new report from YouGov might provide useful insights.

MWAA returning to downtown Chicago in July

Tuesday, May 14, 2024

The Midwest Acquirers Association's 22nd annual conference will take place Wednesday and Thursday, July 24 and 25, 2024, at the Chicago Marriott Magnificent Mile.

Rhetoric over Credit Card Competition Act heating up

Monday, May 13, 2024

Senator Richard Durbin, D-Ill., is on a tear. Last week he took to the Senate floor to lash out at Visa Mastercard and airline companies, which he accused of being in cahoots in trying to convince Americans that his proposed bill, the Credit Card Competition Act, will eighty-six rewards programs. Not so, the senator said.

Green Sheet interviews AU10TIX's Ofer Friedman

Monday, May 13, 2024

News broke recently that the full ID information and photos of 80 percent of El Salvador's population were made available for free on the dark web. Ofer Friedman, chief business development officer at identity management experts AU10TIX, recently shared insights about this incident with The Green Sheet.

TikTok and other items that caught our eye this week

Friday, May 10, 2024

TikTok isn't going away quietly. The company filed a lawsuit against the United States on May 7, 2024, in response to a bill passed by the House of Representatives that could lead to a nationwide TikTok ban over national security and data privacy concerns linked to its Chinese connections.

Credit card late fee cap going into effect May 14 – or is it?

Thursday, May 09, 2024

As we reported previously, the Consumer Financial Protection Bureau, on March 5, 2024, finalized a rule to reduce typical credit card late fees from $32 to $8, a change aimed at relieving American families who pay over $14 billion annually in such penalties. This rule, effective May 14, 2024, targets the largest issuers, representing over 95 percent of the credit card market.

Recurring payments in an instant-payments world

Wednesday, May 08, 2024

While recurring payments are not the most popular way to for consumers to pay merchants, it is rare to find an individual or family that does not have at least one type of recurring subscription payment—utilities, gym memberships, mobile phone service. You get the picture.

May is Small Business Month – Here's a cheat sheet

Tuesday, May 07, 2024

The following article by Chad Otar, CEO of Lending Valley Inc., offers a preview of what's included in our May 13, 2024, issue. The entire issue, which also features articles from Leo Arzumanyan, Elie Y. Katz, Allen Kopelman, Dale S. Laszig and Ken Musante, will go live online early next week:

BlueSnap settles FTC charges for working with bad actors

Monday, May 06, 2024

The Federal Trade Commission disclosed a significant enforcement action against global payments technology provider BlueSnap Inc., its former CEO Ralph Dangelmaier, and Senior Vice President Terry Monteith, for their alleged roles in facilitating transactions for deceptive businesses.

Interesting things we came across this week

Friday, May 03, 2024

If you want to break into the hospitality market, check out the National Restaurant Association's show coming up May 18 through 21, 2024, at McCormick Place in Chicago.

If you don't fix security problems, crooks will come

Thursday, May 02, 2024

If there were a meter for detecting cyberattacks, it would be sounding today off like a Geiger counter hitting a stash of gold. That's pretty much the upshot of Verizon Business's 2024 Data Breach Investigations Report (DBIR).

Retailers seek to deep six interchange settlement

Wednesday, May 01, 2024

It's looking like the proposed settlement in a class-action lawsuit between Visa, Mastercard and a class of merchants over interchange isn't about to end, despite a proposed settlement. The National Retail Federation asked a federal judge to reject the proposal, characterizing it as a "backroom deal."