Page 1 - GS171202

P. 1

December 25, 2017 • Issue 17:12:02

Payments by the numbers: 2017

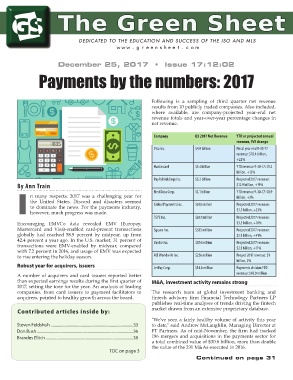

Following is a sampling of third quarter net revenue

results from 10 publicly traded companies. Also included,

where available, are company-projected year-end net

revenue totals and year-over-year percentage changes in

net revenue.

Company Q3 2017 Net Revenue YTD or projected annual

revenue, YoY change

Visa Inc. $4.9 billion Fiscal year end 9-30-17

revenue: $18.4 billion,

+22%

Mastercard $3.4 billion YTD revenue 9-30-17: $9.2

billion, +15%

PayPal Holdings Inc. $3.2 billion Projected 2017 revenue:

By Ann Train $12.9 billion, +19%

First Data Corp. $3.1 billion YTD revenue 9-30-17: $8.9

n many respects, 2017 was a challenging year for billion, +3%

the United States. Discord and disasters seemed Global Payments Inc. $930 million Projected 2017 revenue:

to dominate the news. For the payments industry,

I however, much progress was made. $3.5 billion, +23%

TSYS Inc. $852 million Projected 2017 revenue:

Encouraging EMVCo data revealed EMV (Europay, $3.3 billion, +10%

Mastercard and Visa)-enabled card-present transactions Square Inc. $585 million Projected 2017 revenue:

globally had reached 58.9 percent by midyear, up from $2.1 billion, +41%

42.4 percent a year ago. In the U.S. market, 31 percent of Vantiv Inc. $554 million Projected 2017 revenue:

transactions were EMV-enabled by midyear, compared $2.1 billion, +11%

with 7.2 percent in 2016, and usage of EMV was expected

to rise entering the holiday season. ACI Worldwife Inc. $226 million Project 2017 revenue: $1

billion, 2%

Robust year for acquirers, issuers JetPay Corp. $14.6 million Payments division YTD

A number of acquirers and card issuers reported better revenue: $43.9 million

than expected earnings results during the first quarter of M&A, investment activity remains strong

2017, setting the tone for the year. An analysis of leading

companies, from card issuers to payment facilitators to The research team at global investment banking and

acquirers, pointed to healthy growth across the board. fintech advisory firm Financial Technology Partners LP

publishes real-time analyses of trends driving the fintech

Contributed articles inside by: market drawn from an extensive proprietary database.

"We've seen a fairly healthy volume of activity this year

Steven Feldshuh ...................................................................................33 to date," said Andrew McLaughlin, Managing Director at

Don Bush .................................................................................................36 FT Partners. As of mid-November, the firm had tracked

Brandes Elitch ........................................................................................38 196 mergers and acquisitions in the payments sector for

a total combined value of $30.6 billion, more than double

the value of the 231 M&As executed in 2016.

TOC on page 3

Continued on page 31