The Green Sheet Online Edition

November 22, 2010 • 10:11:02

Upward surge continues in electronic payments

The Electronic Transactions Association's newly released U.S. Economic Indicators Q3 2010 Report, compiled by The Strawhecker Group, offers a comprehensive analysis of macro and micro economic and payment data to help payment professionals assess their prospects in the current economic climate.

As the U.S. economy began to show signs of recovery, electronic payments fared well, with total retail sales up 7.34 percent this year from September 2009, according to the report.

"Even as consumer payments dropped, and that's what we saw during the recession, the growth in electronic payment market share occurred at a faster rate than the decline in overall payments," Mike Strawhecker, Director of Marketing and Strategic Research for Strawhecker, told The Green Sheet.

A new chart in the report tracks quarterly changes in U.S. gross domestic product against bankcard volumes since 1989. "You can see over each dip in the economy, the recessionary periods, bankcard volume continues to take off, especially from 2001 up until now," said Bob Loewens, Junior Associate at Strawhecker.

"It's experienced almost exponential growth over the time period, despite recessionary periods, which shows the resiliency of the payments industry."

Strawhecker added that throughout the recession, "one thing we did see, which I would note, places like discount stores and drugstores showed less of a drop than stores like Abercrombie & Fitch.

"The things that people have to buy at a drugstore like Walgreen's, those merchants showed more resiliency. Similarly, the payments industry is resilient in that by necessity every type of merchant takes cards."

Debit and e-commerce gain momentum

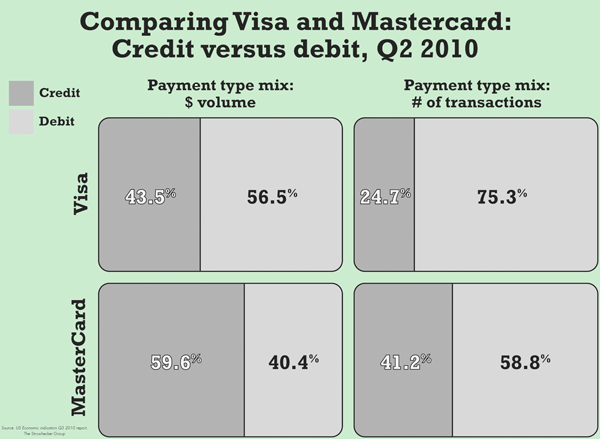

According to the report, Visa Inc. credit card volumes are up over 6 percent from a year ago, with debit accounting for 56.5 percent of Visa's total card volume in the second quarter of 2010, while MasterCard Worldwide's debit volume was at 40.4 percent over the same period.

In terms of the actual number of transactions, debit comprised 75.3 percent of Visa's total card transactions versus 58.8 percent for MasterCard during the second quarter of 2010. "Even though there is less credit out there, because of the higher use of debit, acquiring companies are still increasing their revenues," Strawhecker said. One reason he cites for this change is that more people are turning to debit for online payment of monthly household expenses like utilities.

E-commerce retail sales also reflected steady gains with six consecutive quarters of growth and year-over-year sales up by 14 percent. Strawhecker added that eBay's share is substantial; it controls 54 percent of the e-commerce market through subsidiaries Bill Me Later and PayPal Inc.

Portfolio values on the mend

For acquirers, merchant attrition is one of the leading indicators of portfolio condition, and the latest report features a new section devoted to the subject.

"This is important to every acquirer, because when you're valuing a company or you're trying to value your own acquirer to buy or sell, attrition is, in our opinion, one of the top factors that determine value," Strawhecker said.

Loewens said the firm looks at attrition "on a net basis, meaning the change in activity of a merchant portfolio from one time period to the next due to closed accounts, where the merchant either went out of business or to a competitor. Then we look at the change in the accounts that were retained over the time period."

Loewens added that attrition rates typically follow the pattern of U.S. same-store sales volumes. "As we've seen over the last few quarters, U.S. net new business births have been negative since about Q1 in 2008, so typically an ISO or acquirer is going to see more business loss. Same-store sales were negative over that time period as well, so it's a double threat to the attrition of a portfolio."

However, Loewens noted that conditions are improving with the rebound in same-store sales and attrition rates declining from a record 29 percent in early 2009 to 21 percent for 2010.

"We look at a lot of portfolios and I think typically pre-recession, 15 percent attrition was the ballpark average for a portfolio," Strawhecker said.

As to whether 20 percent attrition will become the 'new normal' as suggested in the report, he added that at this point, "we can't say, but what we are seeing right now is that attrition is drastically dropping following the pattern of same-store sales."

According to Strawhecker, publicly traded companies in the TSG Payments Index listed in the report have outperformed the S&P 500.

"One reason why the payments companies have performed better than the overall marketplace is the business model of those payment companies with the residual income model," he said. "Revenues are more reliable, more predictable, so that's very attractive to an investor."

For more information, visit www.electran.org or www.thestrawgroup.com.

Notice to readers: These are archived articles. Contact information, links and other details may be out of date. We regret any inconvenience.