The Green Sheet Online Edition

April 25, 2011 • 11:04:02

Research Rundown

|

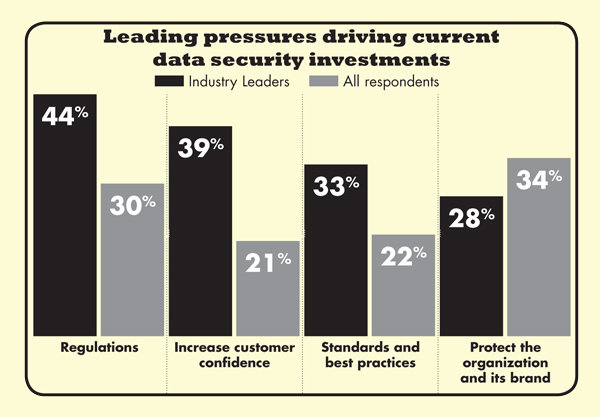

Research suggests enhanced security can increase online transactions A research brief by the Aberdeen Group reported that high-performing companies with e-commerce sites are 1.7 times more likely than lower-performing companies to have current deployments of extended validation (EV) secure socket layer (SSL) certificates. Because EV SSL certificates require a more rigorous vetting process before issuance, they provide end-users with a higher level of confidence in conducting online transactions, the brief stated. The EV SSL certificate standard calls for certain conditions to be met on the part of the company requesting the certificate. Among the conditions are that the company be a legally recognized entity created by an appropriate legal filing, have a registered agent or registered office within the jurisdiction of incorporation, and have a verifiable physical existence and business presence. According to Aberdeen, the greater level of security required to obtain the EV SSL certificates translates to greater customer trust and ultimately to a higher level of online sales. An EV SSL-certificated site is denoted by a green address bar displaying the name of the organization that owns the certificate and the name of the certification authority. "Over time, more and more end-users are becoming conditioned to 'look up' to the green address bar, which gives them higher assurance that their personal data is being encrypted while in transit and that the website they are connecting with has been authenticated based on a more rigorous industry standard," the report stated. www.aberdeen.com/aberdeen-channel/it-security/itsa.aspx Primary POS  |

- Patricia Hewitt, Director of Mercator Advisory Group's Debit Advisory Service DDoS popular with hackers Distributed denial of service (DDoS) attacks jumped to the number one attack method targeting computers and network servers. DDoS attacks were up 22 percent during the second half of 2010, compared with the first half of that year, according to Trustwave's Web Hacking Incident Database semiannual report. Fraud decreases in U.K. For the second year, the U.K. has seen a significant drop in the value of online and MO/TO fraud, which fell by an estimated 10 percent to £239 million in 2010, compared with £266 million in 2009, said a press statement from Retail Decisions, a payment fraud prevention and detection company. Americans ready for online health bill payment Seventy-three percent of Americans would use a secure online communication solution to make it easier to pay medical bills, get lab results, request appointments and communicate with their doctors' offices, according to a survey conducted by Intuit Health. Agencies to double paperless payments In the next three years, businesses, government entities and nonprofit organizations plan to double their use of paperless payment technologies, according to a survey of more than 280 accounts payable professionals by U.S. Bank, the International Accounts Payable Professionals and the APQC. |

Notice to readers: These are archived articles. Contact information, links and other details may be out of date. We regret any inconvenience.