The Green Sheet Online Edition

September 26, 2011 • 11:09:02

Research Rundown

|

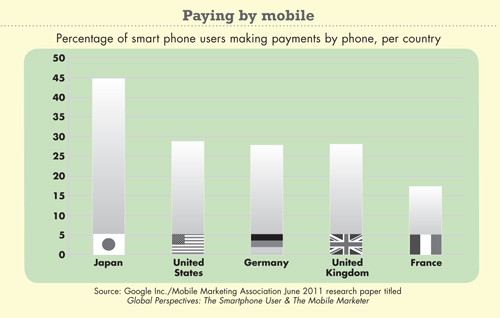

Mobile payment transactions growing to $150 billion Mobile payment (m-payment) options are being rapidly accepted by consumers and are working so well that m-payment transactions are expected to reach $150 billion by the end of 2011 and $556 billion by 2016 - an annual projected growth rate of 30 percent, a Visiongain Ltd. management report stated. The Mobile Payment: Operator Strategies, Opportunities and Challenges Report 2011 said m-payment growth is due to the ever increasing number of mobile subscribers, which is expected to reach 6.4 billion by 2016. The number of m-payment users is expected to grow from 140 million at the end of 2011 to 750 million in 2016. "Repeated studies have proven that there is a considerable consumer demand, potential for consumption, conducive industrial environment and the commitment on the part of its stakeholders to make this growth happen," the report said. "The issues which need urgent attention and redressal at this point by the industry are the lack of standardization and guaranteed security solutions." The authors believe they have conservatively estimated the growth potential of the m-payment sphere. Western Europe is expected to grow at the most rapid rate in its adoption of m-payment (37.3 percent) technology. The authors noted more than 50 million Japanese favor near field communication (NFC) technology on their phones as their preferred payment option. The authors expect India and China to quickly follow with wide NFC adoption. "The adoption of NFC will continue to gain momentum, and Visiongain believes that by 2016, 658 million mobile phones will be enabled with NFC," the company stated. Visiongain feels the great advantage of NFC is security. Data can be securely encrypted using the Advanced Encryption Standard, which the authors stated is particularly important for the ever more popular mobile wallets. They noted many NFC systems also use time-based tokens that change credit card numbers every few seconds.  |

- Nizar Assanie, Vice President of Research, IE Market Research Corp First Research looks at processing industry First Research, a sales research and intelligence company, released a new report that looks at the advantages and disadvantages of large versus small processing companies in the U.S. card processing industry. The report, Financial Transaction Processing, revealed there are approximately 2,000 U.S. processing companies with combined annual revenue of about $40 billion. It stated the industry is heavily concentrated with about 50 companies accounting for 85 percent of the industry revenue. Increasing importance of VARs and ISVs to ISOs Value-added resellers (VARs) and independent software vendors (ISVs) are becoming more important to ISO profitability, a new report from the Aite Group LLC titled The Increasing Role of VARs and ISVs in U.S. Merchant Acquiring found. Aite Senior Analyst and report co-author Adil Moussa said that in addition to competing to attract merchants directly, acquirers also now compete to become default acquirers for merchant software solutions. Significant increase in malware on mobile platforms A new report from McAfee Inc. said mobile phone operating systems are increasingly targeted by malware, and Android devices are the world's most attacked device. The McAfee Threats Report: Second Quarter 2011 revealed attacks on Android devices increased 76 percent from the first quarter of 2011. The report authors called the first half of 2011 "the busiest ... in malware history." |

Notice to readers: These are archived articles. Contact information, links and other details may be out of date. We regret any inconvenience.