The Green Sheet Online Edition

January 14, 2013 • 13:01:01

Five predictions for billing and payment in 2013

In 2013, we will experience a year of transitions and fast-moving innovation in the world of billing and payments. Financial institutions and billers are in prime positions to harness changes to make customer relationships more intimate and profitable. However, they also face risks in trying to keep up with, manage and budget for rapidly changing consumer preferences. From a billing and payment perspective, in 2013, a breakthrough year, we will see the following:

1. Mobile billing and payment usage will grow

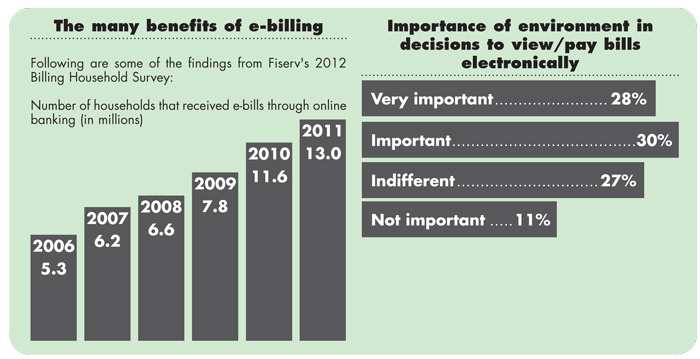

Mobile billing and payment is driven by the customers' need to have anytime, anywhere access to their information. Half of online households now have a smart phone, and the number of people paying bills via smart phone increased 41 percent in 2012 compared to 2011, according to Fiserv's 2012 Billing Household Survey.

Thanks to the growing adoption and increasing functionality of the tablet and smart phone, more and more consumers will leverage these devices to access their finances.

2. Billers and financial institutions will continue to adapt to the needs of mobile consumers

Billers and financial institutions will launch new services and expand existing capabilities, particularly mobile ones, as they move to meet the billing and payment preferences of today's hyper-changing consumers. More consumers will leverage tablets and apps in order to conveniently access and manage their billing and payment needs.

3. Paperless e-billing will hit a milestone

Mobile capabilities will be a catalyst for e-bill growth, providing the critical value-added differentiator over the paper bill and overcoming the number one barrier to adoption: reminder to pay the bills.

The average percentage of bills delivered as (paperless) e-bills by billers will hit 20 percent in 2013. Most billers can expect to see e-bill usage increase by 3 to 5 percent from current levels by 2013.

4. Consumer usage of plastic to pay bills will increase

This bill payment behavior will increase primarily because consumers will use credit cards as a way to maximize their reward/loyalty points. In addition, there will be an increase in the use of prepaid cards (among those who use prepaid cards). This is especially true now that over half of consumers don't use or rarely carry checkbooks.

5. Social payments will gain momentum

While most of the 16 billion person-to-person payments made each year are with cash or checks, electronic payments between people, also known as "social payments," are an emerging trend. Look for more of these payments - such as rent payments, gifts or reimbursements for bill-split among roommates - to become electronic in 2013.

Editorial Note: This list of predictions for 2013 and accompanying highlights from Fiserv Inc.'s 2012 Billing Household Survey were created by Eric Leiserson, Senior Research Analyst at Fiserv, and published by Fiserv on Dec. 13, 2012. Reprinted with permission. All rights reserved; © 2012 by Fiserv.

Notice to readers: These are archived articles. Contact information, links and other details may be out of date. We regret any inconvenience.