The Green Sheet Online Edition

October 27, 2025 • 25:10:02

Chief Payment Officer (CPayO): the role that doesn't exist - but should

For decades, companies assumed that everything related to money belonged to finance. Finding and opening new bank accounts, integrating them with the CRM system, reconciling statements, managing cash flow… these were all part of the traditional bookkeeping, which sat comfortably under the CFO.

This was logical at a time when banks and payment providers were predictable, straightforward, and one bank was the same as the other. Now, that era has passed.

Today, payments and banking have more power over an operation than ever: they determine whether a business succeeds or fails. Fintech has become a very complex scene where banks change their requirements suddenly and constantly, funds get blocked, accounts can be closed, and on top of all of this, prices are totally subjective.

Innovative fintechs introduce new opportunities but also a lot of new risks at a pace few can follow. Payments and banking now affect UX, risk management, technology, product development, data security, compliance, finance and more. It should be treated as a standalone function, an essential part of business strategy, yet most companies still rely on tools and processes designed for a time when payments were considered mere administration.

An unfair burden on finance

The gap between how payments actually work and how they are managed has widened dramatically. Finance teams, trained in accounting, reporting and budgeting, are suddenly expected to make decisions in areas completely outside their scope, such as UX, settlement timelines, data security, integrations and provider due diligence, which naturally leads to mistakes when these areas lie far beyond their training and expertise.

Accountants and CFOs are still dragged into technical meetings and regulatory conversations where they can barely keep up, forced to make decisions without understanding even the basics, let alone their wider impact. This creates a significant risk that many still fail to recognize.

The most critical part of any business operation is the movement of money, but it rarely has a true owner. What should be a carefully structured flow connecting every area of the operation often ends up scattered between departments, handled in isolation and decided without understanding how one change impacts another. Not many businesses know this, but every small adjustment in payment and banking flows has consequences. A single missing document can block an account, delaying settlements for weeks, while introducing new payment methods such as crypto can easily lead to the closure of traditional bank accounts or increased processing fees as the activity becomes classified as "high risk."

These consequences are too expensive to remain the sole responsibility of finance.

Where leadership must step in

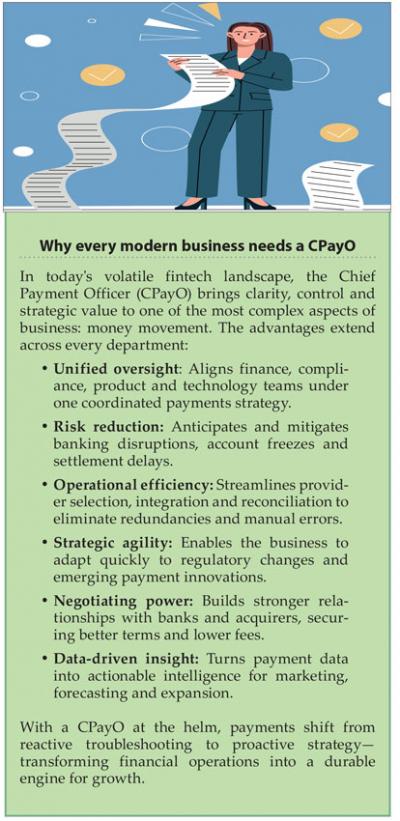

The introduction of a Chief Payment Officer changes this dynamic. The CPayO brings senior ownership to the most sensitive part of business operations, building the structure around how banks think, how providers assess risk, and how money should move to support growth rather than limit it. They create a coordinated system where product, compliance, finance, technology and compliance decisions align with one another instead of working at cross-purposes.

The CPayO reviews and selects every provider based on far more than pricing: their settlement terms, technology, reporting standards, risk profile and licensing conditions must all fit the business model and flows. They design processes that make sense to banks and acquirers, earning trust from the beginning rather than attempting to patch credibility after a rejection or compliance issue.

Most importantly, they establish internal governance, so every department understands how its actions affect payment flows and how each decision connects to the larger picture.

#h2Turning a risk Into a strategic asset When payments and banking receive proper leadership, the results are immediately measurable. Fund times become predictable, marketing "works" due to successful targeting based on payment data, and most importantly, the company operates with a cash flow contingency plan based on actual viability. This shift transforms payments and banking from a risk into a competitive advantage.

A well-structured payment and banking strategy understands and uses the latest fintech innovations to scale without interruption, enter new regions with confidence, negotiate better terms and conditions with providers, and respond quickly to regulatory or political changes that would otherwise derail operations.

The CPayO is the architect of this system, the executive function that turns money movement from danger into the backbone that supports growth, stability, and long-term resilience.

The Chief Payment Officer

The CPayO does not replace the CFO or COO but works alongside them, with an independent mandate to orchestrate decisions across finance, product, compliance, technology and legal. The CPayO understands how banks think, how funds move internationally, and how every decision affects risk, liquidity and growth. By centralizing ownership, they transform how the operation thinks about payments and banking.

The CPayO is no longer optional. Every day without this role leaves companies exposed to failures and costs that could have been otherwise prevented. Businesses that recognize this reality, appoint a CPayO and gain stability, efficiency and trust. Those that continue to ignore it gamble their future on structures never designed to withstand the demands of today.

Viktoria Soltesz is the CEO and founder of PSP Angels and The Soltesz Institute. She is a leading advocate for strategy-led financial operations, ethical industry practices, and structured education in an area too often overlooked in traditional business training. PSP Angels is a globally awarded, independent payment and banking consultancy that has supported over 1,000 companies in building scalable, secure financial infrastructures. The Soltesz Institute is the first and only independent online organization offering EU-accredited training and certifications focused exclusively on payments and banking. To contact Viktoria, please email viktoria@pspangels.com.

Notice to readers: These are archived articles. Contact information, links and other details may be out of date. We regret any inconvenience.