Page 15 - GS190202

P. 15

IndustryUpdate

in the industry, including cash, cards, credit transfers, lessly pay vendors with American Express Business or

direct debits and checks from 2014 through 2018. The Corporate cards, without setting up a new card account,

report also analyzes various payment card markets and the partners said, adding that the solution improves

provides data on number of cards in circulation and working capital and cash conversion cycles, and pro-

transaction values and volumes. vides better data for payment reconciliation, all while

helping businesses earn rewards.

ETA examines fintech impacts on underserved

ATMIA, ASA join forces permanently

The Electronic Transactions Association released a white

paper exploring how financial technology (fintech) inno- The ATM Security Association and the ATM Industry

vation broadens access to financial products and servic- Association signed a final agreement to join forces and

es. How FinTech is Addressing the Needs of the Underserved work together permanently. ASA will retain its name

highlights the financial institutions, payments compa- and logo and will now fall under the governance and

nies and fintech companies transforming the market- ownership of ATMIA. The agreement, which comes into

place through the introduction of new technologies that immediate effect, is the culmination of the successful

are expanding accessibility, lowering costs, empowering aligned work achieved under the earlier Memorandum

financial management, and driving a more secure eco- of Understanding signed in March last year, the partners

system. said.

PARTNERSHIPS NBP adds Banner Season Marketing

National Benefit Programs added Banner Season

AmEx, Bill.com introduce Vendor Pay Marketing LLC to its offerings. Banner Season enables

clients to send greeting cards and branded, personalized

American Express Co. and Bill.com formed a strategic gifts to their customers. "This discounted program gives

partnership offering American Express "Vendor Pay" our customers access to the Design Studio for free (nor-

by Bill.com. Vendor Pay couples automating accounts mally $9.95 per month)," NBP stated. "Merchants can

payable process with the ability for businesses to seam- turn their prospects and clients into your biggest fans."

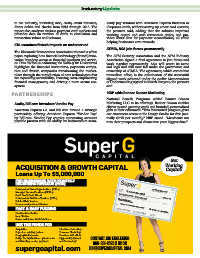

Get

ACQUISITION & GROWTH CAPITAL Working

Capital!

Loans Up To $5,000,000

FOR BUSINESSES WITH MONTHLY

RECURRING REVENUE (MRR)

Independent Sales Organizations (ISO’s)

Managed Service Providers (MSP’s) YOUR BUSINESS Apply Today!

SaaS, IaaS, PaaS, Cloud LOANS UP to $5,000,000

Independent Software Vendors (ISV’s) Super G Capital 1,000,000

Point of Sale Vendors www.SuperGCapital.com

Insurance Agents and Brokers Borrow against your MRR!

FAST & EASY FUNDING Super G Capital

Flexible Amortization

Non-Dilutive

Senior and Junior Debt Solutions

USE THE FUNDS FOR

Acquisition Hire More Sales Reps

Buyout an existing partner Increase Marketing

Geographic Expansion Purchase A Portfolio

Bridge the Gap between upfront costs Upgrade Equipment CONTACT JON ENGLEKING

and time they receive payment and Technology 800-631-2423 x 112 or

supergcapital.com Jon@SuperGCapital.com