The Green Sheet Online Edition

August 22, 2011 • 11:08:02

Mobile payments present new sales channel

The availability and affordability of smart phone-based payment solutions represents a great opportunity to expand into what will be for ISOs and merchant level salespeople (MLSs) an entirely new and virtually untapped market: direct sales. This sector involves independent sales representatives who sell consumer goods person to person, usually in homes and offices.

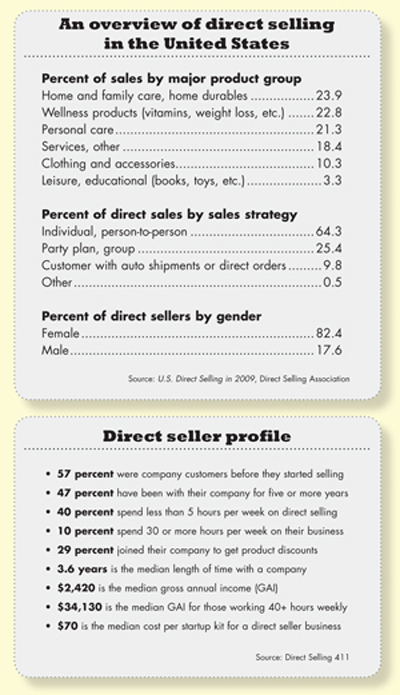

Direct sales accounted for an estimated $28.33 billion in retail sales for 2009, according to the Direct Selling Association, the national trade association for businesses that manufacture and distribute goods and services sold directly to consumers.

The largest growth sector of this industry has been in multilevel marketing, a concept involving distributors who sign up independent sales representatives and earn commissions on the sales made by those reps. Amway is a prime example of this type of business. Another concept is the party plan, which involves representatives holding sales "parties" at customers' homes.

There are over 6 million individuals, representing 22,000 establishments, distributing products through direct sales in the United States. Sales exceed $28 billion a year, according to the DSA.

Low penetration

Credit and debit card use in this market segment is extremely low. Industry data shows the average ticket amount when a bankcard is used is in the $200-plus range. But less than 1 percent of the estimated billions of dollars spent in this market is charged to credit and debit cards.

According to the DSA, the majority of independent sales representatives work part-time (less than 30 hours a week) and relatively few can justify the expense and fee structure of using dedicated mobile payment terminals.

These entrepreneurs might typically be accepting less than 30 card transactions monthly, so they aren't likely to pay $600 to $700 for a wireless terminal.

But they're undoubtedly running into issues with customers who don't want to see them writing down their credit card numbers to be entered later into a PC. Who knows what could happen to those loose slips of paper?

High mobile phone use

Before the advent of smart phone-based payment systems, few ISOs and MLSs would think of this market segment as one worth the effort. That's no longer the case.

Many, if not most, independent sales representatives own smart phones (or can acquire them at relatively low cost) that they use for email, calendaring, web searching and direction finding, in addition to making phone calls.

Since they already own the core platform and means of communication and are paying for a data plan, the only issue is how to convince them to adopt mag stripe readers for their phones at little, if any, upfront cost.

It should be an easy sell. The basic proposition is simple: increased sales. The ability to accept credit and debit cards anywhere reduces the threat of bounced checks and lowers the risks associated with carrying around large amounts of cash. And that's just the payment aspect; these mobile systems also free up time previously needed for recording card transactions and writing out receipts, which can now be emailed to customers.

Where to start

Given that the payment acceptance device is likely already in their hands, direct sales associates represent a tantalizing potential market for ISOs. Now you just have to figure out how you're going to track down the right independent sellers.

Average revenue per distributor is fairly low, so it's important to focus your sales efforts on direct seller products that are expensive enough to warrant card payments and the benefits that come with them.

From a marketing viewpoint, the major association that supports this industry is the DSA. Most companies involved in the direct selling business are members of this group. A good place to start is the DSA's membership website - www.dsa.org and the organization's more consumer-friendly site, www.directselling411.com - where you can research the nature of the market and the characteristics of your target direct sellers.

Programs set up through the companies in this business may provide access to individual distributors either through regional or national meetings, newsletters, or direct mail.

Sales representatives may frequent meetings of local business organizations, which makes for a conducive environment to pitch the benefits of mobile card payments. Some may advertise in community newspapers.

Then you have to have the right portfolio of hardware, software and services that make sense for the particular direct sales reps you are targeting. While most are likely to be receptive to a smart phone-based solution, those with greater volume and higher ticket-price items might be better suited for dedicated devices.

There's no doubt that it's harder to find individual sales representatives who, unlike brick-and-mortar merchants, don't have storefront operations. But it's also plain that this is a largely untapped market with great potential for electronic payments.

Gene Distler is Vice President, North America Mobile Solutions, with VeriFone. He can be reached at gene_distler@verifone.com.

Notice to readers: These are archived articles. Contact information, links and other details may be out of date. We regret any inconvenience.