The Green Sheet Online Edition

December 10, 2012 • 12:12:01

Mobile banking provides a pathway to mobile payments

As new entrants to payments such as Isis, Google and Apple grab headlines, it can be easy to overlook banks and their mobile activity. Financial institutions have an important role to play in any future payments framework, and they are leveraging their own assets and capabilities to create a pathway to mobile payments.

At the end of the third quarter, the three largest banks in the U.S. announced that their mobile banking activation is approaching 30 million customers and is growing at close to 30 percent per year. Activity is also intensifying at the other end of the spectrum with smaller banks adopting advanced features such as mobile remote deposit capture of checks.

As mobile banking adoption continues to grow, banks will be able to leverage their existing customer base, along with their role as trusted financial custodians, to help shape mobile payments.

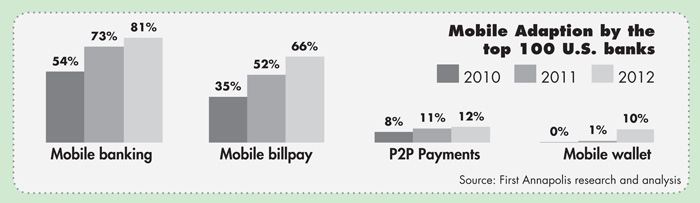

As part of its third annual Mobile Banking and Payments Study, First Annapolis examined the consumer-facing mobile offerings of the top 100 U.S. financial institutions (FIs) to evaluate mobile banking and payments adoption. Since the emergence of mobile banking five years ago, financial institutions have steadily improved functionality to provide customers with increased opportunities to access and control their personal finances using their mobile devices.

Currently, 81 banks offer mobile capabilities to their customers, up from 73 last year, and 54 in 2010. From the simplest features (such as account balance inquiries) to advanced payments functionality (like person-to-person [P2P] transfers and mobile wallets), the constant innovation has begun to blur the lines between banking functions and payment activities.

While credit unions and institutions without retail payments offerings are concentrating almost exclusively on banking functionality such as mobile remote deposit capture (mRDC) and mobile bill pay, the largest banks and most credit card issuers are progressing even further down the pathway to payments. In addition to offering bill pay as a mobile option, these larger financial institutions recently began aggressively promoting features that allow customers to manage credit card rewards, view and redeem offers, and earn loyalty points from their favorite retailers, all from a mobile device.

Nine banks have now instituted in-app rewards redemption functionality while four now offer mobile coupons directly through the bank interface. These offerings are slowly bridging the gap between traditional account management and the bank's new role as a facilitator of mobile commerce.

P2P payments allow the FIs to further expand this role by enabling direct transfers from a bank account to another individual through networks such as Popmoney and clearXchange.

While incorporating these new marketing and payments features, banks have also expanded their activity in mobile wallets. Over the last year, mobile payment headlines have been dominated by discussion of various wallet concepts and their potential to transform the way consumers spend money.

While technology companies, mobile network operators and even retailers have garnered most of the attention for their competing models, card-issuing banks are playing an increasingly larger role as both partners and developers in this space. Since Citi joined with Google in 2011 as a first-to-market, mainstream wallet initiative, nine other banks have announced partnerships or trials to enable mobile payments for their customers.

While some partnerships merely make it easier to add bank cards to wallets that are owned and operated by technology companies, a few banks are taking a proactive approach to developing innovative new marketing and payments tools.

Examples include Sovereign Bank's loyalty incentive program with LevelUp and Bank of America's recently announced payments trial using 2D bar codes. These developments represent cutting edge functionality offered by financial institutions and demonstrate banks' increasing activity in the growing mobile payments space.

However, banks face many competitive pressures from inside and outside of the industry as they develop the latest mobile features and functionality, and there is no obvious path forward in such a fragmented and fast-paced technology environment. Effectively targeting investments in this mobile environment requires a different strategy for large card-issuing banks compared to smaller credit unions and non-issuing banks.

For larger issuers, new investments should enable payment products and further integrate payment and deposit accounts. The pathway to payments for these banks will likely also involve the adoption of marketing and rewards functionality to provide additional compelling use cases for consumers to adopt a bank-provided wallet.

For smaller banks, mobile priorities should remain focused on core functionality improvement and deposit account management. Features like mRDC and intuitive servicing options can help smaller institutions compete for customers with the largest U.S. banks based on the utility of their offerings.

While heretofore mobile has mostly been an interesting new servicing channel, banks are now recognizing that mobile banking is a necessary customer interface (particularly for the affluent, tech-savvy and underserved segments) and a critical platform for providing a pathway to payments. But just offering account access functionality will not be enough; banks need a wallet and marketing strategy that leverages their roles as trusted payments providers and effective managers of risk in order to succeed in the new digital payments landscape.

For more information, please contact Stephen Kiene, Consultant specializing in Mobile Commerce and Emerging Payments, at stephen.kiene@firstannapolis.com; or Jeff Crawford, Senior Consultant specializing in Mobile Commerce and Emerging Payments, at jeff.crawford@firstannapolis.com.

Editorial Note: This article was first published in First Annapolis Navigator, October 2012 edition; copyright © First Annapolis Consulting; all rights reserved.

Notice to readers: These are archived articles. Contact information, links and other details may be out of date. We regret any inconvenience.