Page 39 - GS170601

P. 39

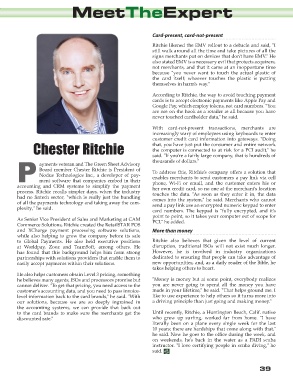

MeetTheExpert

Card-present, card-not-present

Ritchie likened the EMV rollout to a debacle and said, "I

still walk around all the time and take pictures of all the

signs merchants put on devices that don't have EMV." He

also stated EMV is a necessary evil that protects acquirers,

not merchants, and that it came at an inopportune time

because "you never want to touch the actual plastic of

the card itself; whoever touches the plastic is putting

themselves in harm's way."

According to Ritchie, the way to avoid touching payment

cards is to accept electronic payments like Apple Pay and

Google Pay, which employ tokens, not card numbers. "You

are not on the hook as a retailer at all because you have

never touched cardholder data," he said.

With card-not-present transactions, merchants are

increasingly wary of employees using keyboards to enter

customer credit card information into gateways. "Doing

Chester Ritchie that, you have just put the consumer and entire network

the computer is connected to at risk for a PCI audit," he

said. "If you're a fairly large company, that is hundreds of

thousands of dollars."

ayments veteran and The Green Sheet Advisory

Board member Chester Ritchie is President of To address this, Ritchie's company offers a solution that

Nodus Technologies Inc., a developer of pay- enables merchants to send customers a pay link via cell

P ment software that companies embed in their phone, Wi-Fi or email, and the customer enters his or

accounting and CRM systems to simplify the payment her own credit card, so no one at the merchant's location

process. Ritchie recalls simpler days, when the industry touches the data. "As soon as they enter it in, the data

had no fintech sector, "which is really just the bundling comes into the system," he said. Merchants who cannot

of all the payments technology and taking away the com- send a pay link use an encrypted numeric keypad to enter

plexity," he said. card numbers. The keypad is "fully encrypted, and it's

point to point, so it takes your computer out of scope for

As Senior Vice President of Sales and Marketing at CAM PCI," he added.

Commerce Solutions, Ritchie created the RetailSTAR POS

and XCharge payment processing software solutions, More than money

while also helping to grow the company before its sale

to Global Payments. He also held executive positions Ritchie also believes that given the level of current

at Worldpay, Zooz and TeamSoft, among others. He disruption, traditional ISOs will not exist much longer.

has found that this background helps him form strong However, he is involved in industry organizations

partnerships with solutions providers that enable them to dedicated to ensuring that people can take advantage of

easily accept payments within their solutions. new opportunities, and, as a daily reader of the Bible, he

takes helping others to heart.

He also helps customers obtain Level 3 pricing, something

he believes many agents, ISOs and processors promise but "Money is money but at some point, everybody realizes

cannot deliver. "To get that pricing, you need access to the you are never going to spend all the money you have

customer's accounting data, and you need to pass invoice- made in your lifetime," he said. "That helps ground me. I

level information back to the card brands," he said. "With like to use experience to help others so it turns more into

our solutions, because we are so deeply ingrained in a driving principle than just going and making money."

the accounting systems, we can provide that back out

to the card brands to make sure the merchants get the Until recently, Ritchie, a Huntington Beach, Calif. native

discounted rate." who grew up surfing, worked far from home. "I have

literally been on a plane every single week for the last

10 years; there are hardships that come along with that,"

he said. Now he goes to the office during the week, and

on weekends, he's back in the water as a PADI scuba

instructor. "I love certifying people in scuba diving," he

said.

39