Page 47 - gs180802_flipbook

P. 47

Education

MSPs must be diligent, of course, in choosing their Of course, while the cost to the business can

technology partners. Because payments is a highly be 0 percent through a surcharging model,

regulated industry, merchants will have questions about

compliance. To many of them, accepting credit cards at the customer bears the cost of credit card

0 percent cost seems too good to be true. A technology acceptance. These costs must be handled fair-

provider that offers surcharge solutions should be able to ly and consistently to abide by the card brand

explain how the company complies with the card brand rules mandating that surcharges not exceed 4

rules, ensuring the merchant partner is passing on the fee

in full compliance. percent and that no surcharges are assessed to

debit cards.

Furthermore, MSPs should look to partner with a

technology company that offers a 0 percent cost for credit

card acceptance, capitalizing on the simple, transparent and MLSs to find and compete for new business. Both

messaging that comes with a true zero cost solution. merchants and acquirers have long been seeking an alter-

native to traditional processing that ensures merchant af-

Finally, ISOs and MLSs should ensure that their technol- fordability and MSP profitability.

ogy providers can provide a turnkey solution, not only

for retail but also for MO/TO and ecommerce. Many busi- With the strong market tailwinds and increasing adoption

nesses prefer to work with a consistent, hassle-free solu- of surcharging, ISOs and MLSs should strongly consider

tion across all environments. partnering with a technology company to include a fully

compliant surcharge solution in their product offerings.

The widespread adoption of interchange-plus pricing has

led to relentless competition within merchant acquiring

and an unsustainable race to the bottom in pricing. The Evan Weese is the Marketing Lead for CardX, a Chicago-based technol-

introduction of surcharging creates a new model for ISOs ogy company that provides credit card acceptance solutions to business-

es, government and education. He can be reached at evan@cardx.com.

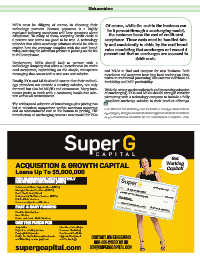

Get

ACQUISITION & GROWTH CAPITAL Working

Capital!

Loans Up To $5,000,000

FOR BUSINESSES WITH MONTHLY

RECURRING REVENUE (MRR)

Independent Sales Organizations (ISO’s)

Managed Service Providers (MSP’s) YOUR BUSINESS Apply Today!

SaaS, IaaS, PaaS, Cloud LOANS UP to $5,000,000

Independent Software Vendors (ISV’s) Super G Capital 1,000,000

Point of Sale Vendors www.SuperGCapital.com

Insurance Agents and Brokers

FAST & EASY FUNDING Borrow against your MRR! Super G Capital

Flexible Amortization

Non-Dilutive

Senior and Junior Debt Solutions

USE THE FUNDS FOR

Acquisition Hire More Sales Reps

Buyout an existing partner Increase Marketing

Geographic Expansion Purchase A Portfolio

Bridge the Gap between upfront costs Upgrade Equipment CONTACT JON ENGLEKING

and time they receive payment and Technology 800-631-2423 x 112 or

supergcapital.com Jon@SuperGCapital.com