Page 30 - GS231001

P. 30

Education

Card network merchants and payfacs should consider them with their

strategy and solution selection.

non-interchange Single but higher

pass-through fees Merchant fees are complex. Many single pricing solutions

like Square have gained market share by providing mer-

chants simplified pricing. However, these solutions are

typically more expensive. Simplified pricing solutions

understand interchange and price merchants to ensure

all costs are covered. These solutions also benefit from re-

turns: they typically do not refund merchant fees in the

event of a return or chargeback, even when interchange is

returned to them.

But even for single pricing solutions, non-interchange and

penalty fees make pricing more complex, and these in-

creasing fees now represent a meaningful amount. More

importantly, they aren't the same with every acquirer. It

depends on the solution provider's capabilities.

Despite their complexity, interchange fees are publicly

available and better understood than non-interchange

pass-through fees. Merchants generally understand in-

By Ken Musante terchange is based on card type, merchant category code,

Napa Payments and Consulting method of entry and data transmitted with the transac-

tion.

isa and Mastercard have been inserting fees

and increasing others so that the total paid No schedule for non-interchange fees is publicly available

to the card networks is far in excess of the from either card network. There isn't even a common name

V traditional assessments. Many newer fees are for them. Some describe them as "pass-through fees," but

designed to shape behavior and are dependent on mer- in that context, they are akin to interchange—and these

chant actions and the solution provider's capabilities. are not interchange. Interchange is paid 100 percent to the

card issuer. These fees are paid to the card networks.

Merchants, especially large merchants, must be more

aware of these fees and ensure solution providers assist The birth of an acronym

in minimizing or avoiding them. They also must consider The most notable, non-interchange fees are the assess-

these fees—in addition to interchange, processor discount ments, which are 0.13 percent to 0.15 percent of gross vol-

and related fees—when

considering total pay-

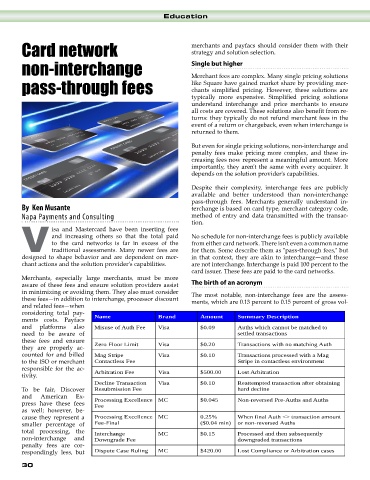

ments costs. Payfacs Name Brand Amount Summary Description

and platforms also Misuse of Auth Fee Visa $0.09 Auths which cannot be matched to

need to be aware of settled transactions

these fees and ensure

they are properly ac- Zero Floor Limit Visa $0.20 Transactions with no matching Auth

counted for and billed Mag Stripe Visa $0.10 Transactions processed with a Mag

to the ISO or merchant Contactless Fee Stripe in contactless environment

responsible for the ac-

tivity. Arbitration Fee Visa $500.00 Lost Arbitration

Decline Transaction Visa $0.10 Reattempted transaction after obtaining

To be fair, Discover Resubmission Fee hard decline

and American Ex-

press have these fees Processing Excellence MC $0.045 Non-reversed Pre-Auths and Auths

as well; however, be- Fee

cause they represent a Processing Excellence MC 0.25% When final Auth <> transaction amount

smaller percentage of Fee-Final ($0.04 min) or non-reversed Auths

total processing, the

non-interchange and Interchange MC $0.15 Processed and then subsequently

Downgrade Fee

downgraded transactions

penalty fees are cor-

respondingly less, but Dispute Case Ruling MC $420.00 Lost Compliance or Arbitration cases

30