Page 34 - GS220702

P. 34

Education

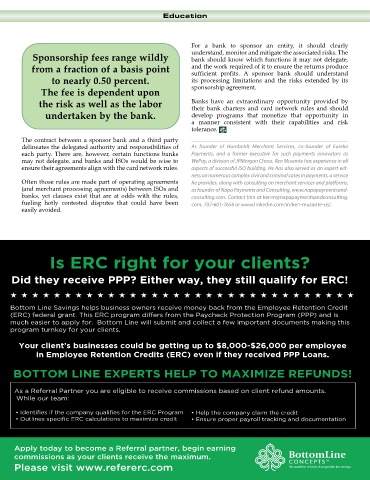

For a bank to sponsor an entity, it should clearly

Sponsorship fees range wildly understand, monitor and mitigate the associated risks. The

bank should know which functions it may not delegate,

from a fraction of a basis point and the work required of it to ensure the returns produce

sufficient profits. A sponsor bank should understand

to nearly 0.50 percent. its processing limitations and the risks extended by its

The fee is dependent upon sponsorship agreement.

the risk as well as the labor Banks have an extraordinary opportunity provided by

their bank charters and card network rules and should

undertaken by the bank. develop programs that monetize that opportunity in

a manner consistent with their capabilities and risk

tolerance.

The contract between a sponsor bank and a third party

delineates the delegated authority and responsibilities of As founder of Humboldt Merchant Services, co-founder of Eureka

each party. There are, however, certain functions banks Payments, and a former executive for such payments innovators as

may not delegate, and banks and ISOs would be wise to WePay, a division of JPMorgan Chase, Ken Musante has experience in all

ensure their agreements align with the card network rules. aspects of successful ISO building. He has also served as an expert wit-

ness on numerous complex civil and criminal cases in payments, a service

Often those rules are made part of operating agreements he provides, along with consulting on merchant services and platforms,

(and merchant processing agreements) between ISOs and as founder of Napa Payments and Consulting, www.napapaymentsand-

banks, yet clauses exist that are at odds with the rules, consulting.com. Contact him at kenm@napapaymentsandconsulting.

fueling hotly contested disputes that could have been com, 707-601-7656 or www.linkedin.com/in/ken-musante-us/.

easily avoided.

Is ERC right for your clients?

Did they receive PPP? Either way, they still qualify for ERC!

Bottom Line Savings helps business owners receive money back from the Employee Retention Credit

(ERC) federal grant. This ERC program differs from the Paycheck Protection Program (PPP) and is

much easier to apply for. Bottom Line will submit and collect a few important documents making this

program turnkey for your clients.

Your client’s businesses could be getting up to $8,000-$26,000 per employee

in Employee Retention Credits (ERC) even if they received PPP Loans.

BOTTOM LINE EXPERTS HELP TO MAXIMIZE REFUNDS!

As a Referral Partner you are eligible to receive commissions based on client refund amounts.

While our team:

• Identifies if the company qualifies for the ERC Program • Help the company claim the credit

• Outlines specific ERC calculations to maximize credit • Ensure proper payroll tracking and documentation

Apply today to become a Referral partner, begin earning

commissions as your clients receive the maximum.

Please visit www.refererc.com